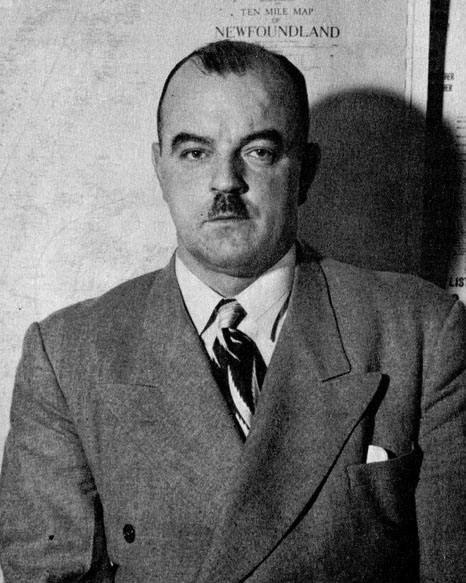

Mr. Hickman Mr. Chairman, before the

Secretary reads the report I would like to say that

I do not intend to introduce it with a long talk,

because after it has been read it will be only a

matter of duplication. I would like to point out

that, with respect to local industries, pulp and

paper, mining, fisheries and forestry have their

own committees, so consequently we could not

touch on those and had to confine ourselves to the

smaller or secondary industries. We did not have

any statistics or sources of information whatever.

We tried several channels but could not get anything on which to base our report.

That presented

quite a difficulty with the result that the report is

not as complete as if there had been a statistical

department of the government which had kept

these figures over a number of years, and which

could have given us comparative figures. This is

a disappointment to the Committee, and perhaps

to you too. The Committee worked very hard, and

everything possible was done. You will see now

that we have had a job in collecting a lot of that.

[The Secretary read part of the report]

Mr. Cashin May I ask Mr. Hickman to turn back

to page 3. I notice here that tobacco and cordage

are grouped as one. Was it not possible to have

them separate?

Mr. Hickman No. The questionnaire was sent

out separately and we received one reply from the

industries.

Mr. Cashin I appreciate there are many members in this Convention who may not understand

protective tariffs, and that is why I asked Mr.

Hickman why these three things were put

together. You will probably remember 22 years

ago I made my House of Assembly debut on

protective tariffs, and one of these industries was

tobacco. That's one particular fault I find with

this report; it does not show the protective tariff

these industries have. I agree in principle they

should have a certain amount of protection, particularly when they are local, but

here is one now

that says it will not give full particulars, the

Imperial Tobacco Co. Over 60% of the stock of

that company is held outside the country, approximately 60% on watered stock, and

they

have a protection of....

Mr. Cashin When the company started we will

assume that they have so many shares, I am

bringing my mind back 20 years, and at that time

they had watered their stock several times. That

means that if they put in $100 and they were

getting 15% on it, then the next year, if they

watered it and made those shares worth $200, that

would mean that they were getting 30% on their

original investment.

Mr. Cashin If they have a good year, and they

pay a 20% dividend on their common stock, they

would "water" that and give two shares for one.

I am not particularly opposed to protective tariffs,

but this company has $550,000 a year in protective tariffs, and I think the people

of this country

should know, and also the members of this Convention. What is the use of this Convention

if we

can't get these facts? Here we have it borne out

— three companies gang up and say, "We won't

give the facts". I did not intend to speak on this,

but I saw here that they had 218 employees

between the three of them, and they pay $400,000

wages that is about $1,700 on average. Now some

of our other industries that belong to Newfoundland and have protection, pay much

more

on an average than these people do to their

employees. They are also paying 45% dividends

on theirstock. This is fact and it should be known.

The protection has been increased by the Commission govemment. I am sorry that we

have not

got a copy of the tariff here, so that we could work

it out. I think I gave some statistics to some

296 NATIONAL CONVENTION February 1947

gentlemen of that Committee to show the tariff

protection There is an excise tariff and an import

duty, and the difference between the two is the

protection they get. If you look up the blue book

of the Customs you will see how much is

manufactured in the year and how much is imported, and work out the protection by

that. Here

is an industry controlled by the British American

Tobacco Co., one of the largest tobacco companies in the world, and it has a protection

tariff

of $550,000 a year.

Mr. Smallwood I intended to discuss the very

matter Major Cashin has raised, but not to do it

until the report was finished reading. I guess how

is the time to go into it. I have a great deal of

admiration for the work that the Committee has

done. Any of us can see they put in a lot of work.

I know the terrible difficulty they must have had

because I have been doing that kind of thing

myself, trying to get the same figures. It is one of

the complaints that I have against this government that they have not got, after 13

years, any

department to gather together just the ordinary

facts and figures and statistics to show what the

country is worth, the value of the goods

produced, and of the manufactures. We and the

government and Mr. Hickman's committee do

not know, because there is no one to tell them.

This matter of protective tariff, I can't agree with

Mr. Cashin, or with the Committee, in drawing

too sharp a line between those local industries

whose capital is owned outside the country, and

those whose capital is owned inside the country.

So far as the consumers of Newfoundland are

concerned it does not make much difference who

owns the capital, if the effect of a high protective

tariff or a high customs tariff is to drive up the

cost of living.... Why draw the line? The enquiry

that has to be made is on the effect of the tariff on

all local industries. That's the enquiry that ought

to be made. It is true the Committee goes on to

say that it would require investigation by accountants and economists in order to

determine

the degree of protection these local companies

get. If it is so it is a pity that the Local Industries

Committee did not make an effort to get an accountant and economist to do that job.

We are

down now to one of the most fundamental things

that we have to face. I heard Major Cashin in this

very chamber stand up 20 years ago, and I heard

him say that if he had his way he would take every

local industry in this country and burn it to the

ground. Now he did not mean that I know, but

what he was getting at then, and also this afternoon, and what I am trying to get

at, is this: taking

Newfoundland as a whole, we know that in a

local industry the employees get their living and

the owners get their dividends, so a local industry

is certainly good for those who are employed in

it and for those who own it, but is that local

industry good for Newfoundland? Industries are

good, but I would point out this fact, and it is the

thing that we have to keep in our minds, and if

we run into the danger of forgetting it we are

going wrong. Every man, woman and child in this

building and in this country today, is eating food

and wearing clothes, footwear, etc, bought from

the money that comes back into Newfoundland

for the fish, the paper and the minerals we ship

out. That's the only money we have, what we get

back for these three things. That's all we have to

live on — how we divide it up is another matter....

There is no other money, except during the war

when we had a lot of Canadian and American

money for base construction. There is a little

dribble still coming in. The only money that we

live on is what comes into Newfoundland from

Spain, Portugal, Italy, the West Indies, etc. for

fish, and from Canada and England for iron ore

and paper, not what is produced in these local

industries. They don't produce a single cent of

new money, they only have their share of the fish,

paper and mineral money. What follows from

this? That it is absolutely necessary for this

country to make the cost of fishing, of manufacturing paper, of mining, as cheap as

we can make

it. Are we doing that? Yes, I am afraid we are.

How? Down through the years whenever we

wanted to cut down the cost of producing fish we

cut down the price we gave the fishermen. How

did we cut down the cost of producing iron ore?

By cutting the wages of the miners. And how did

we cut down the price of paper? By cutting the

wages of the men in the mills. But that is not the

way to do it. One way is to cut down the cost of

living, and these local factories are not cutting it

down, they are making it higher. That's what is

meant in this paragraph here. What does it say?

They received 39 replies, which in their case

showed a yearly total of wages, salaries, etc. of

$3,981,000, and a yearly total of taxes, including

customs, taxes, excise, etc. of $4,800,000. Where

February 1947 NATIONAL CONVENTION 297

did that $4,800,000 come from? It came from the

fishermen, the paper makers and forest workers

and from the miners in Bell Island and Buchans

by making the cost of living higher. That's what

the local industries mean. I am far from satisfied

with what this report shows, but I don't blame the

Committee. It is one of the things that we have

kept hidden in this country. I only know a few

men, some in this house today, who are very

much alive to the effect of the protective tariff.

Here it says, "It can be clearly understood that the

tariff in effect today is a revenue tariff." Who says

it is?

Mr. Smallwood They have a perfect right to do

so, just as I have a perfect right to disagree with

the Committee. You can't say that our tariff in

Newfoundland today is a protective tariff, or a

revenue tariff, it is both, and the people pay it all.

Every cent of it comes out of the fish and the

paper and the minerals, and drives up the cost of

living. Some day someone has got to get down to

brass tacks and find out once and for all just how

far these local industries are justified, just how far

it pays the 315,000 of our population to have this

protection on these local industries.

I believe in local industries. I would be a

terrible fool if I did not, but what industries? I

believe in the industries that are natural to the

country, eg. fish.... We have the raw material

right here, and it is only a matter of hauling it out

of the water and curing it, tinning or bottling or

freezing it. Let's encourage the industry in every

way. What else is natural? Paper making, because

we have the timber and the waterpower.

Minerals, because we have the minerals. Furring,

because we have the animals, and gaming because we have the game. These are the industries

we ought to foster and protect.

You have it summed up magnificently by the

Industrial Development Board, if I can anticipate

just for a moment. "The local Industrial Board

have done a fine job ... considered the possibility

of making cement". That's all right because we

have the raw material to make cement. They sent

away samples and had them analysed and the

report came back that it would make a first-class

Portland cement. But why could they not go

ahead with a cement industry? Because some of

the raw materials are on one side of the island,

and the rest on the other side, and it would be too

expensive to bring them together to manufacture

them into cement. All you have to do is put a high

tariff on imported cement. Make out the cost of

bringing the raw materials together from east and

west and the cost of manufacturing them, and it

comes to $5 a bag to produce it here in Newfoundland. Well, make the price $5.60 for

the

imported cement by putting on a high tariff. If

you can do it for other things why not do it for

cement? Putting a protective tariff on an imported

article makes it more expensive then the local

article and drives up the cost ofliving. It was said

by Major Cashin 20 years ago, and it is a wonderful thing how Major Cashin and l are

growing to

agree with each other, I hope to convert him

before I am finished! Some day we have got to

go into this question of our tariff, above all our

protective tariff....

I don't want to say too much because the man

who will stand up and express any doubt that

these local factories are divinely blessed is likely

to be hounded out of the island. I agree they are

an imposition, and the people of the country will

never live while these duties are on, and they have

got to come off. I had better sit down before I say

too much. I am not saying a word against Mr.

Hickman's committee, or against him. The

figures are not here, and the government have not

got them. If they had a royal commission they

would not get them. You can't blame the Committee for not bringing in information

that the

government has not got. I had to get this off my

chest or burst.

Mr. Higgins Now that Mr. Smallwood has not

completely burst, I want to make a comment that

I am sure he will answer. I am a little upset about

this unholy alliance of Mr. Smallwood and Major

Cashin, but I suppose these things are bound to

happen! The thing that puzzles me is that we have

30 manufacturers making returns, and in these

concerns there are 2,300 employees. And if these

are burned or closed down what would be the

position of these employees of all those concerns? What would they do?

Mr. Smallwood Let us take any given article,

say a microphone (a very favourite article of

mine); say there is a factory manufacturing them

in St. John's. The materials have to be imported,

so the government puts a duty on the raw material

used to make these microphones of say 30%, but

298 NATIONAL CONVENTION February 1947

on the completed microphone that might be imported into the country they put a duty

of 40% or

50%, which is aprotection of 10% or 20%. I don't

say close down the manufacturers, I say take off

the 30% duty on the raw materials, and all the

duty on the finished article, wipe out the duty

completely.

Mr. Higgins What is the real difference then so

far as profits to these manufacturers are concerned?

Mr. Smallwood I am not worried about the

profits, I am worried about the cost of living — I

have to pay more, like all of us. I am not a

shareholder in a local factory, if I were — I am

big enough to know what human nature is like —

no doubt I would like a high protective tariff, no

duty at all on the raw material, but say 50% or

60% on the finished article, so that I would have

a protective tariff of 40% or 50%. That's if I were

a shareholder. I am a consumer, and so are all of

us, and I am interested only in the cost of living.

Mr. Higgins Whilst I don't disagree with you,

how is the government going to make up the

difference in their duties under your scheme?

Mr. Smallwood Well, Mr. Cashin told us a few

minutes ago what he said 20 years ago, and I will

remind you of what I said 20 years ago in the

MCLI

[1] in a debate they had up there. I said the

day would come in Newfoundland when there

would be a political party and on their banner

they would inscribe two words "Direct Taxation", not indirect taxation as you have

today in

our customs tariff. The Chadwick-Jones report

tells us that in the last year they report the percentage of the total revenue was

risen to 30% —

30 cents out of every dollar they took in direct

taxation, but that still left you 70 cents to the

dollar that was taken in by indirect taxation. I

would say it ought to be the other way about —

70% by direct taxation and not more than 30% by

indirect taxation. That is what is crucifying the

people of this country and always did....

There was a time in Newfoundland when the

tariff amounted to 8% or 10%. Go back 20 or 30

years ago, when you got a duty of 20% it was

something unusual. It was the same as it is in

Canada today, about 10%. You take all our imports into Newfoundland last year, you

will find

it in the Chadwick-Jones report, lump them all

together and what was the average rate of duty?

25%. It would be much higher than that if we took

out the free list, the flour and beef, etc., that pays

no duty. It would probably be 40% or more.

We wonder why the cost of living is so high,

and we blame the merchants and the shopkeepers. Maybe some do deserve it, I think

there

is some profiteering, but the real trouble is the

tariff: $19 million we paid the government last

year in duty, and on it $10 million profit, that's

$29 million our tariff tacked on to the cost of

living. There is only one cure for it, to cut the duty

out altogether. A few may be hurt, but I don't

think there is any need to burn down the factories

or shut them down.

Mr. Smallwood He did not really mean that, but

he meant that if you took every employee and

gave them their present wages it would be a

couple of million dollars....

Mr. Smallwood Yes, it would pay this country,

it would pay them well, first to shut down the

factories; second to pay out that $4 million from

the treasury in wages and let them go idle, doing

nothing (we could not do that I know, but it would

pay them); and third to take the duty off and let

the cost of living come down. As Major Cashin

says, cut out these tariffs and let the people live

and breathe which they have never been able to

do.

Mr. Hickman A few of the remarks Mr.

Smallwood has made we have pointed out in the

report. He has not taken them into account. I refer

to one remark on page 8, this $4,800,000 which

he implied, and rightly so, came out of the pockets of the people who made the money.

He implied that if those local industries were not there

the people would not have had to pay that money.

They still would have had to pay it, and perhaps

more. There are certain local industries that do

make things cheaper than the imported articles.

Another thing he said was that local industries are

driving up the cost of goods. We have found that

in many cases the tariff has been reduced since

these companies have been in business. There is

one, clothing, which ran to 65% duty, and is down

today to 35% in spite of local industries being

here.

Mr. Smallwood Was the duty on raw material

February 1947 NATIONAL CONVENTION 299

reduced also?

Mr. Smallwood Do you mean they are still

paying the same duty on the raw materials?

Mr. Hickman To my knowledge. Here again

there is one case brought up in the Committee.

Some years ago the question of biscuits was

brought up and we discovered that the fancy

biscuits brought in here sold for 85 cents a pound.

The local people bought them out and the imported ones were reduced to 45 cents a

pound

immediately. There are certain instances like that

that we recommend there be a thorough study on.

I think that the sweeping statement you made

should be left until the true picture is brought out.

Mr. Smallwood I am trying to bring a plea to

have the facts brought out. I don't say the Committee can do it, but I am only pleading

that it be

done, and let us know where we stand.

Mr. Penney I have served on the Local Industries Board, and I did not intend to have a

word to say. I prefer to sit back and listen until

the report at least is read; but I have listened to

Mr. Smallwood bawling until our eardrums are

ready to burst, and if I had my way I would have

the microphones fired out of this room today and

save the people from having to listen to all this.

Local industries made the United States and

Canada, and are helping to make Newfoundland;

and in the town where I come from they help

support a good number of people, and no man

should attack them. The tariff question is another

matter altogether, and in our report, where we had

doubt about the question of tariff we asked the

Convention to investigate. Common courtesy

would expect members to listen to the whole

report before they make any loud attacks on

industries as a whole.

Mr. Smallwood I am sorry if I have offended

Mr. Penney. I hope that on reflection he will agree

that I have not attacked local industries. I have

not done so. I have attacked tariff protection of

them. In the very fine and historic town from

which Mr. Penney comes, Carbonear, they have

a very fine industry over there, but it is not

protected. It is a magnificent wood industry, and

is one of the industries that are natural to the

country. The raw material is here and you don't

need any tariff protection. Take for instance your

paper industry, that is not protected, on the contrary there is a customs duty on

many things that

go into it, which are helping to hurt it. They have

no protective tariff, but they have to pay duty on

the things that go into it. The industry Mr. Penney

refers to is not only not protected, but it is hurt

because they have to pay duty on some of their

raw material. I say take off the duty and give that

industry a better chance than it has. I am sorry

that I bawled. I can't change my voice any more

than Mr. Penney can change the shape of his nose.

I can't help it.

Mr. Jackman I believe Mr. Smallwood is advocating free trade.

Mr. Jackman Would you expect a little country

like Newfoundland to take off the duty, when

only a few days ago one of our industries is up

for a higher tariff? They want to put 50% more

on our fish, and you advocate free trade when the

United States is advocating a higher rate of duty

on our fish going in there?

Mr. Smallwood I hope no one jumps on me, but

maybe the cure is along the lines that Mr. Job is

suggesting. Maybe we can let their goods come

in here duty free and they will let our goods go in

there duty free. You might have complete free

trade between the USA and Newfoundland. Why

not?

Mr. Jackman Where are the employees

depending on local industries going to get off?

There is also Norway and Sweden and other

places competing with us for our fish, and where

could we get off?

Mr. Hollett Might I ask the convenor of the

Committee, and Mr. Smallwood, whether or not

the protective tariff is a thing unknown in any

other part of the world, or is it just here? Are there

protective tariffs in Canada?

Mr. Crosbie May I correct Mr. Smallwood? He

said there was no duty on lumber coming into this

country. There is a duty on lumber coming into

this country.

Mr. Smallwood There might as well not be. If

there is a local tariff for local lumber it is a pure

waste of printer's ink...

Mr. Hollett I agree with Mr. Penney that it is a

pity that we started this argument before the thing

has been read, however I would refer to the

returns of the tobacco and cordage companies,

where the totals are grouped as one. Why is that

done? I note that these three items pay wages,

300 NATIONAL CONVENTION February 1947

salaries, commissions, etc., of $480,000. Major

Cashin has told us that tobacco alone has a protection of $552,000. If they are, we

are paying

protection of that amount in order to pay out

much less than $480,000 in wages

I am a little bit disturbed by the Committee's

report that they were unable to get the facts from

the manufacturers. When people hesitate to disclose certain matters, especially when

these matters are essential to us here, I am concerned about

it. I don't want them to disclose their dead secrets,

but they should be able to give us something that

would be of assistance to us in coming to a full

appraisal. Iagree in a good many ways with what

Mr. Smallwood has said. There is no question

that he has something here into which he can get

his teeth, and he certainly got them in. I expect

we shall hear more from other members of this

Convention with regard to this report. I predict

for it a very stormy passage.

On page 4 of the report, after telling us how

difficult it was for you to find the facts, you say

there is an Industrial Statistics Act. Why was it

not possible for you to go to that department of

the government and ask them, under that act, to

get the necessary information for you? If the act

is there it is their duty to find it. Did you approach

any person in that department and ask if they

could get the information under that act?

Mr. Hickman We approached the department

that was handling that, and were told that that act

was put on the books in 1938, and that the Department of Public Health and Welfare

used it for

acquiring statistics covering the number of

employees in the various manufacturing concerns and businesses and their wages. At

that time

there were people on relief, and it was used to

check the earning and the number of people

employed. After that period it was not found

necessary for the department to have those

figures, as unemployment became unknown due

to the bases, etc. We asked the department if we

could have this information obtained through the

act. We were advised that it had been transferred

to the Department of Public Utilities, and it

would be in the hands of the Labour Relations

Office. On making inquiries of that department

we found that they did not know it had been

cancelled. After a while we found it would be

under Public Utilities and the Labour Relations

Officer, and we then found that it only covered

employees and wages, and did not cover the great

majority of questions that we wanted. We then

found that to get those particulars which the act

was empowered to obtain would take so long that

it would delay us for months....

[The Secretary continued reading the report]

Mr. Smallwood I wonder if Mr. Hickman

would explain column 5 on page 3. It says "Purchases of Local Raw Materials and Expenses".

What would the local raw materials amounting to

$2.25 million?

Mr. Hickman Without looking up any actual

returns, we did not ask the firms to specify, it

would include packages, wood, shucks, barrels,

berries, and local produce manufactured locally,

bottles, etc.

Mr. Hickman Yes, milk that would go into butter and ice-cream.

Mr. MacDonald In computing the value of

these local industries it strikes me that we should

have some idea of the amount that these companies pay in corporation taxes. I don't

see anything here concerning that.

Mr. Hickman You mean profit taxes? Well,

that was a question that, after consideration, we

did not like to put in the questionnaire. We did

not expect to get any replies if we asked what

profit taxes were paid.

Mr. MacDonald That is an asset to the country,

the amount of taxes that the country is paid.

Mr. Hollett I agree with Mr. MacDonald that

we ought to know what we ought to expect in

connection with that. In the Mining Committee

we approached the big companies and asked

them that, and they had no hesitation in giving us

the information. Why should your Committee be

careful of asking those local corporations for that

information?

Mr. Hickman In the case of a large corporation

their balance sheet is probably published

anyway, but in the case of local small companies

we felt that if we asked the question we would

not have any answer given us as to income tax,

and they might not have answered a lot of the

questionnaires, with the result that we would not

have as much information as we did get.

Mr. Hollett We asked the Assessor of Taxes if

we could have that information and he said no,

but the corporations themselves did give it to us.

Mr. Miller I think with Mr. Hollett that these

February 1947 NATIONAL CONVENTION 301

large companies did give their figures and we

were given permission to use these figures as a

gross total. There is one other point that I would

have liked to have seen in this report, and that is

on the protective tariff, the duties as they would

have regularly been, provided we did not have

that industry here at all. As I see it, this discussion

got a bit away from that, we got down to drawing

examples on the basis of no duties at all. I don't

think that situation has any relation at all when

we are dealing with protective tariffs. I think that

had these tariffs in relation to the different matters

as we found them been figured out, and if we had

a tabulation on these things, that a few figures

there might speak more than a lot of words....

Mr. Smallwood On page 8, the last paragraph,

I wonder if Mr. Hickman would mention that. It

says: "It can therefore be seen rather than

season work which might be directly or indirectly

dependent on that fisheries...." It that means anything, it means that there should

be local industries to provide wages, but which would not

be either directly or indirectly dependent on the

fisheries.

Mr. Hickman It would be dependent on them as

far as the money would derive from these basic

industries.

Mr. Smallwood What do you mean by secondary industries? You don't mean that Corner

Brook and Buchans and Grand Falls are secondary do you?

Mr. Smallwood Well, what kind of industry

could you have that would not be directly or

indirectly dependent on these?

Mr. Hickman That means not dependent on the

fisheries as a cooper, or a longshoreman or anything of that sort. Someone who is

making something that can be sold to the consumer, and which

would provide employment to people who are

today getting employment in the United States or

elsewhere.

Mr. Smallwood You should have left out that

word "indirectly", because it is almost impossible to get an industry which is not

indirectly

dependent on the fisheries.

Mr. Hollett Again on page 8, you consulted the

Board of Trade committee and you say that they

supplied to us figures that they had received in

reply to their questionnaire. Are these figures in

the report? I don't see them.

Mr. Fudge Mr. Chairman, I wonder would the

chairman of the Local Industries Committee say

whether or not they had written W.J. Lundrigan

of Corner Brook in connection with his plant

there, as there are a number of men employed

there.

Mr. Hickman We sent out to all known

manufacturers or local industries.

Mr. Hickman Yes, but we stated that their reply

would be kept confidential and only used in the

total of the category referred to. It was on that

basis that they submitted it.

Mr. Fudge Would you mind stating whether he

said what the number of employees was that he

had there?

Mr. Fudge I have some knowledge of that firm,

because our organisation has an agreement with

that man, and I am prepared to state here that the

rate of wages paid in this wood working plant is

far better than anything else paid anywhere in the

island for local wages. The great bulk of that is

from this particular wood working plant to which

I refer....

Mr. Bailey I see here under boots and shoes, 102

employees, $13,000 duty and excise, $150,000

volume of business, $120,000 capital. For once I

am going to agree with Mr. Smallwood on one

thing. I wonder at what cost to this country that

local industry is carried on. At the end of the last

war I came in contact with quite a bunch of men

who were interested in changing the map of

Europe. One of those rose to a pretty prominent

position in the Czechoslovakian government, and

he explained to me what was going to take place

and what was going to be put into the boot and

shoe industry there. He spoke also of the good

quality of our herring. I suppose today the

country has got an idea of the consumption of

herring in Middle Europe, as they call it. The

humble herring may be nothing at all in this

country, but in those countries it is a luxury. I was

interested, and at that time we had a big export of

herring from this country, but unfortunately, due

to the depression and not being handled right, we

lost that market.... Those chaps, apparently they

were very intelligent and well educated. I

thought, if he banks on going into that position it

302 NATIONAL CONVENTION February 1947

might be all right to get together, and, I do not

understand much about it, but there is a trade

agreement — you buy your stuff from me and I

will buy from you. I supported Sir Richard

Squires and went down with him. I said to him

once, "I don't know much about what can be

done, I am not in the government, but I believe if

this was gone into right we could get the thin edge

of the wedge into Middle Europe". He said,

"What has Czechoslovakia got?" I said, "Boots

and shoes", and he said, "We have a local industry". "Well," I said, "we can't produce

shoes

as cheap as we can herring, and if we don't

produce herring we can't buy shoes whether we

buy them here or not." That's the position. The

first man in this country that you have got to look

to is the primary producer — the fisherman. We

had only a small pulp and paper industry at that

time, and there was lots of talk of the Humber,

and things were pretty tough when fish dropped

from $19 a quintal to around $8. Things were

hitting the fishermen pretty hard. Well, he said he

would take it up and see whatcould be done about

it. He went into it and a month or so afterwards I

happened to go down to Mr. Halfyard's and Sir

Richard was there, and he told me there was

nothing could be done about it because of the

local industries.... We could have been putting

one million barrels of herring into Europe. Now

suppose that one million barrels only gave the

fishermen perhaps $5 a barrel, what would it have

meant to this country during the depression? According to Sir Richard — I won't malign

the man

— the local shoe industry meant more to this

country, but according to what I have heard there

were some boots and shoes imported into this

country from Czechoslovakia; and children's

shoes could have been laid down here for 80 cents

a pair, women's for $1 and men's for $1.20.

There was a tariff, I forget what it was called....

Mr. Bailey I don't care who it hurts or who is

responsible for it, whether they are dead or alive

today, these men went a long way towards bringing on this country what we had in 1936.

I made

a census in 1939 in every village from Lead Cove

to Summerside, Trinity Bay, and the number of

people who died from TB between 1920 and

1930, and between 1930 and 1939 trebled.

Whoever is responsible for this sort of legislation

in this country is responsible for the deaths of

those people, or a part of it, because you can

understand what it would have meant to this

country if there had been $5 million, or only half

that amount during those years. A few people

have been enabled to go ahead and have a profit

at the expense of the health and wealth of the

primary producer of this country....

We are not ashamed of anything we have done

since we came here. If a royal commission came

here they would have the power to find out the

facts, but we have no power at all. I believe the

words that Major Cashin said, "We are a glorified

mock parliament", and that's all. We are not in a

position to do anything. If the responsible

government and Commission of Government

had been up to their jobs, we could have walked

into a certain office and got the information right

away, and certainly they have enough offices,

they are the biggest real estate owners in the

country. We find out that this country has been

run worse than anything I have ever seen in my

life. I don't know who is responsible for it. It

looks to me that we were never intended to find

out the truth about this country....

Referring to the tobacco factory. I was here in

St. John's in 1942 when one of the Commissioners came back from overseas and spoke

for

the boys, and asked people to give money to send

them smokes. At the price we were paying for

cigarettes it looked all right. I had been used to

going to St. Pierre to buy Gem cigarettes for 60

cents a carton, but this gentleman appealing for

smokes for the boys — Wings, one of the

cheapest cigarettes in the world — says, "You

can buy these cigarettes for $1 .20 a carton", when

the merchant in St. Pierre could buy them here

and freight them to St. Pierre and sell them for 60

cents a carton. I am wondering if the honourable

gentleman had shares in the tobacco factory. This

is one of the reason why the cost of living is as it

is. I am not going to take up any more time on

this. I am not against local industries, I believe

we should have more, but let us produce what we

can produce cheapest, and sell to the people who

can manufacture cheapest, so that the cost of

living can be kept down....

Whatever government comes in, the first thing

we have to do is find out who in this world can

take our stuff from us that we can produce and

sell, and take from them what they can produce

the cheapest, and give our people a chance to live.

February 1947 NATIONAL CONVENTION 303

Let us see that our men going to the fisheries get

a square deal so that we can live as a country

should live.

[The Committee rose and reported progress.]

Mr. Chairman Gentlemen, I have to report to

you that in pursuance of the plan adopted a couple

of days ago at an informal session of the Convention, the following were elected to

be members

of the committee to interview His Excellency the

Governor in Commission. These are the members of the committee:

Hon. R.B. Job

Mr. C.A. Crosbie

Mr. G.F. Higgins, K.C.

Mr. T.W. Ashbourne

Mr. J.R. Smallwood

Mr. I. Newell

Mr. F.T. Fogwill

It is necessary that we have a motion formally to

confirm this election I will accept a motion now

from any member of the Convention confirming

the appointment of these gentlemen.

[The motion was put and carried, and the Convention adjourned]